Blog

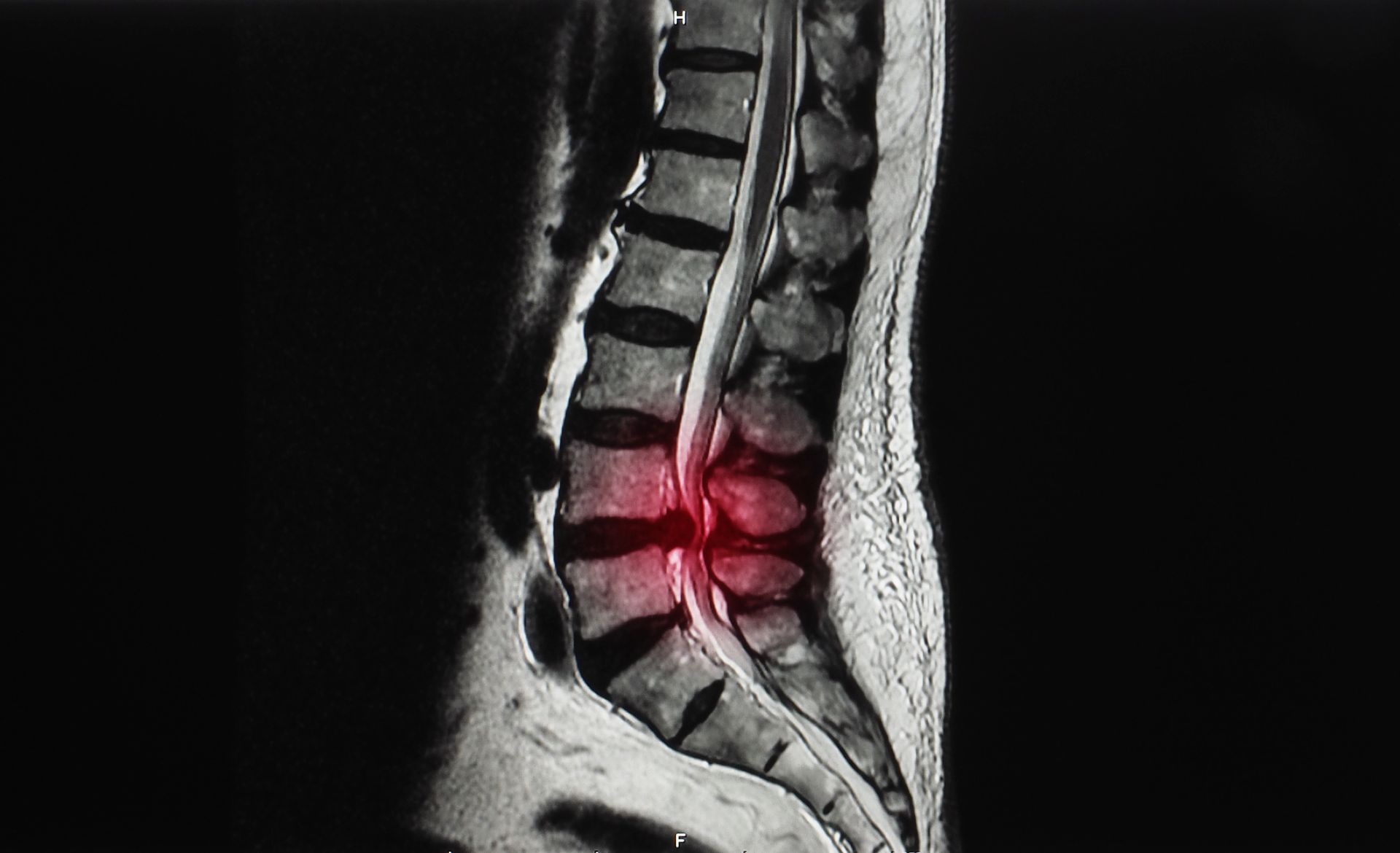

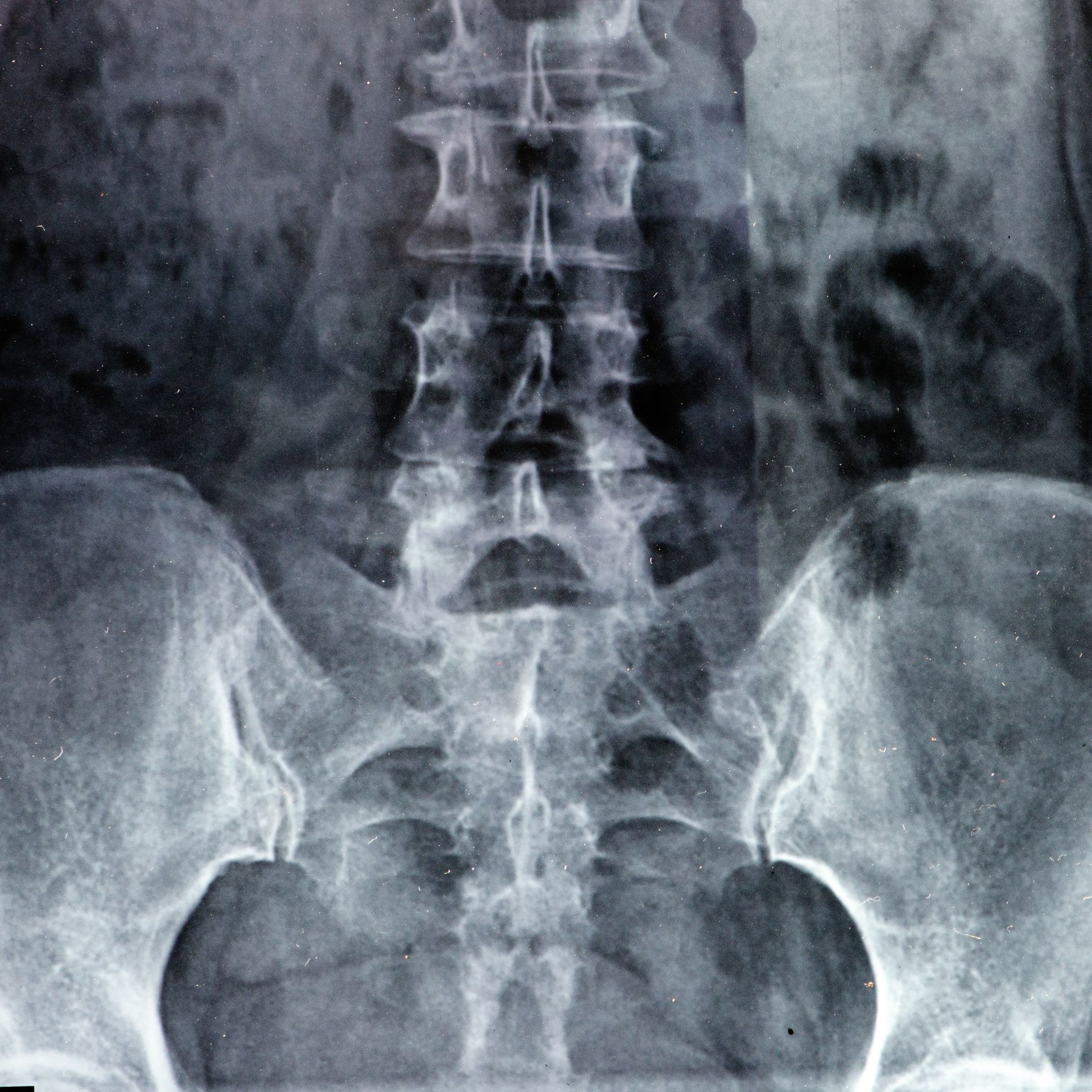

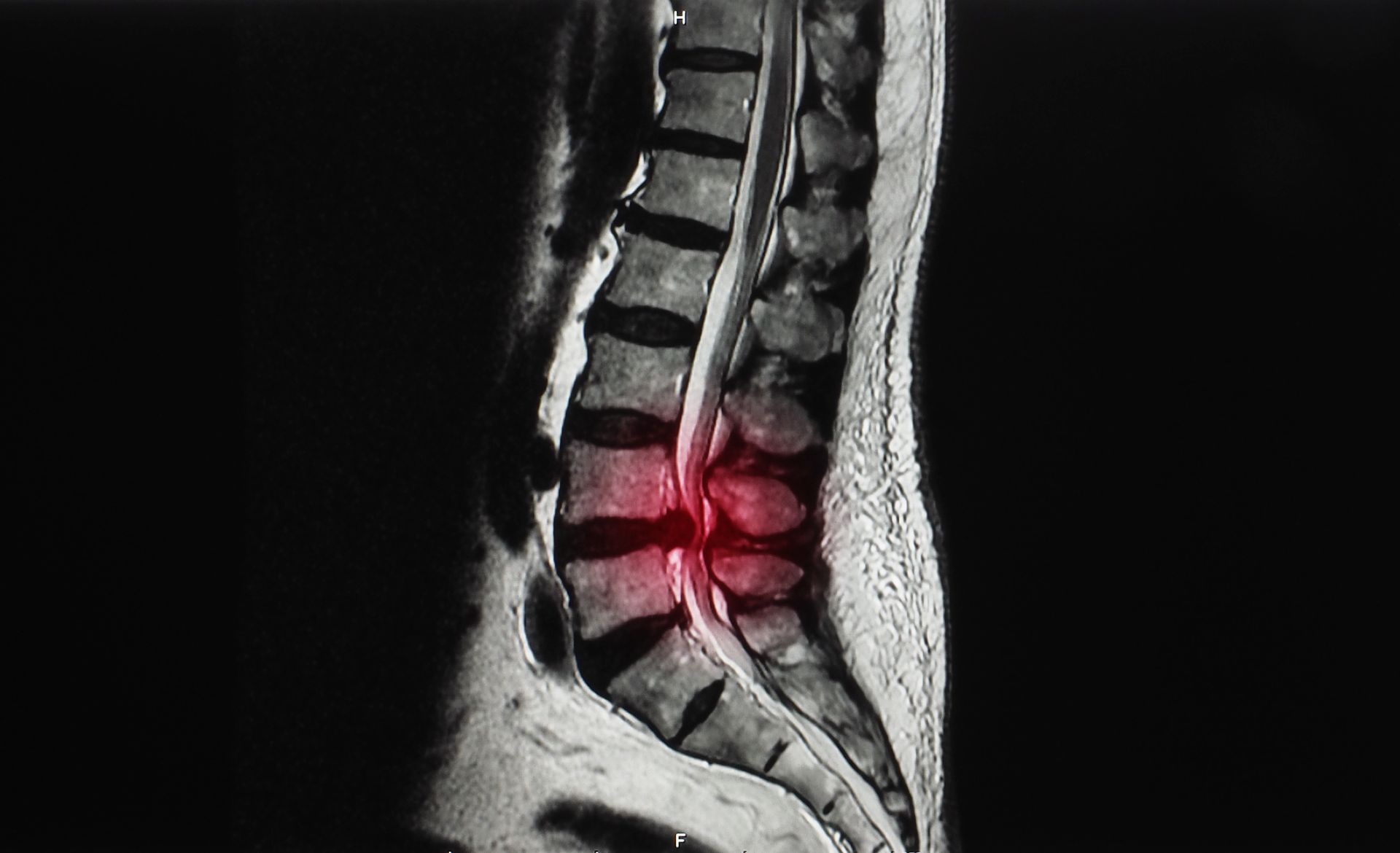

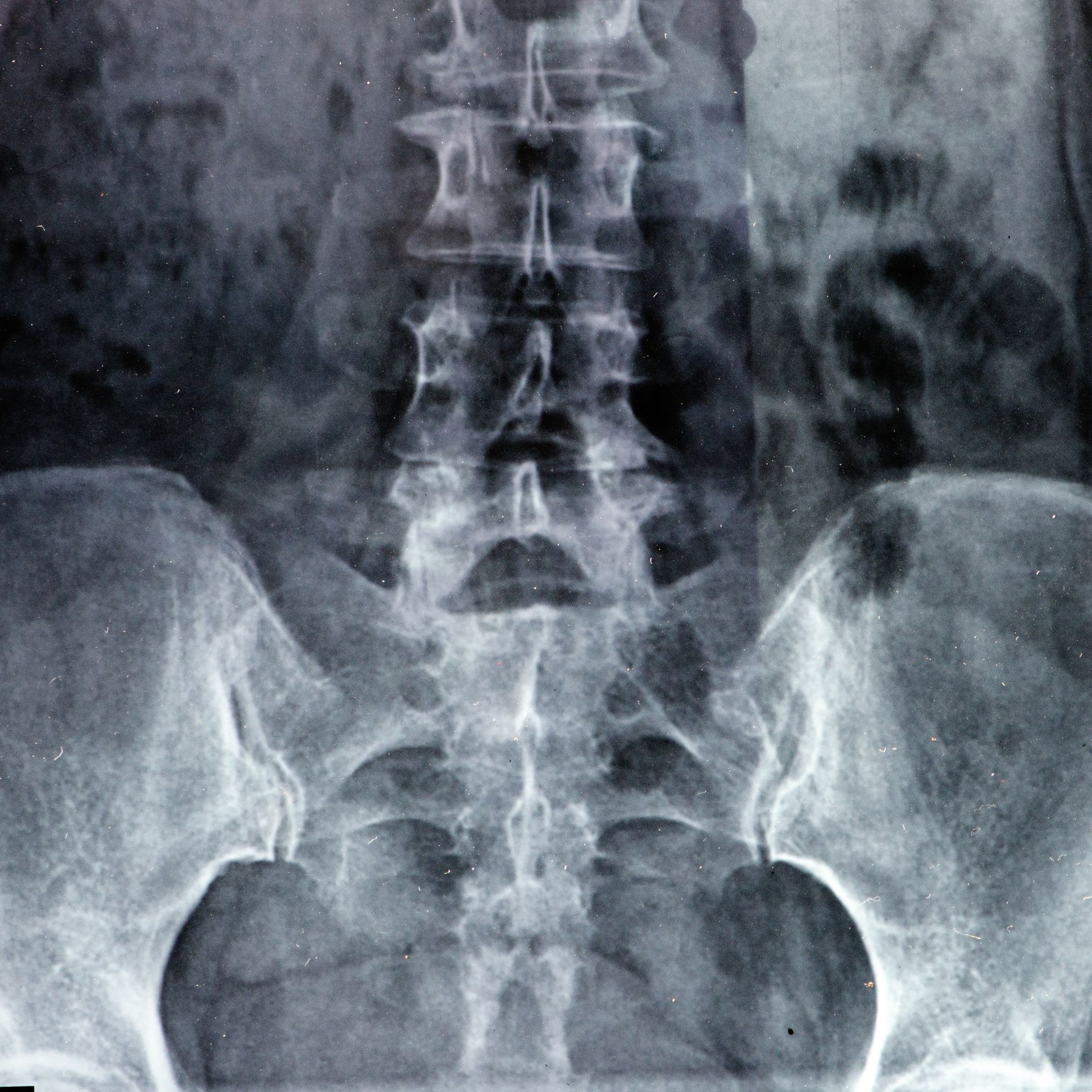

Roughly 2 million people in the U.S. suffer car accident-related injuries each year, according to the CDC. Some are obvious right away — broken bones, whiplash, cuts. Others creep in slowly. One of those is spinal stenosis. Spinal stenosis doesn’t always hit you the same day as the crash. It might show up weeks later — numbness in your arms or legs, pain that radiates down your back, tingling that won’t go away. You might think it’s just soreness or aging. But if the narrowing of your spinal canal started after a car accident, you may be dealing with something serious — and you may be eligible for compensation. If you’ve been diagnosed with spinal stenosis after an accident, or you’re starting to show signs, this article walks you through what it means, how it connects to auto collisions, and what the spinal stenosis claims process looks like. Let’s get right into it. What is spinal stenosis Spinal stenosis is a condition where the spaces within your spine — particularly the spinal canal — become narrower. This narrowing puts pressure on the nerves traveling through the spine, which can lead to significant pain, numbness, and weakness, often in the arms or legs. There are two major types of spinal stenosis: Cervical stenosis, which occurs in the neck Lumbar stenosis, the most common type, which affects the lower back Symptoms depend on the location and severity of the narrowing. People with cervical spinal stenosis might have trouble with balance, coordination, or hand function. Those with lumbar spinal stenosis often report leg cramps, shooting pain down the legs (sciatica), or a heavy feeling when walking. You don’t need to be elderly to develop this. While degenerative changes related to aging are a common cause, trauma — like that from a car crash — can cause similar narrowing by altering the structure of the spine. Can spinal stenosis be caused by an auto accident Yes. Trauma is a recognized cause of spinal stenosis, especially in previously healthy individuals. The spine is a delicate system of vertebrae, discs, joints, and nerves. A high-impact collision can throw it out of balance instantly. Here’s what can happen in a crash: Bulging or herniated discs can protrude into the spinal canal. Fractured vertebrae or bone fragments may press against the spinal cord or nerves. Whiplash injuries, especially in rear-end collisions, can destabilize the spine and lead to long-term inflammation or structural changes. This process doesn’t always trigger immediate symptoms. You might walk away from the accident thinking you’re fine. But over weeks or months, pain, numbness, and weakness may set in as inflammation builds or disc material shifts more into the spinal canal. It’s not uncommon for patients to be diagnosed with spinal stenosis during imaging done weeks after the crash — often after initial treatments for whiplash or soft tissue injuries fail to resolve the pain. This delayed onset makes documentation extremely important. Is spinal stenosis a permanent injury In many cases, yes. Spinal stenosis is considered a degenerative condition, and once it begins, it often doesn’t reverse on its own. Treatment focuses on managing symptoms and slowing progression, not curing the condition. Physical therapy, anti-inflammatory medications, corticosteroid injections, and chiropractic care may help in the short term. But if these conservative treatments don’t offer relief, surgery may be recommended — typically a laminectomy or spinal fusion. Even then, there’s no guarantee of full recovery. According to the National Institute of Neurological Disorders and Stroke, the long-term outcome for spinal stenosis varies widely. Some people maintain function with ongoing therapy; others experience progressive disability. If the condition leads to permanent nerve damage, the effects may include chronic pain, loss of mobility, or loss of function in certain limbs. In legal terms, a permanent injury can significantly increase the value of a personal injury settlement. It impacts your quality of life, your ability to earn income, and sometimes your need for future medical care or home modifications. Can you drive a car with spinal stenosis Possibly — but there are limitations. Driving requires physical strength, quick reaction time, and range of motion. If your spinal stenosis limits any of these, driving could be dangerous to you and others. Cervical stenosis may restrict your ability to turn your head or neck, making it hard to check blind spots. Lumbar stenosis can cause numbness or weakness in the legs, which affects braking or accelerating safely. Long drives might also trigger pain flare-ups or muscle spasms that make it harder to concentrate. If you’re prescribed painkillers, muscle relaxants, or anti-inflammatories, you may experience drowsiness or delayed response times. These side effects can increase crash risk and may invalidate your car insurance in the event of a collision. In some cases, people with moderate to severe spinal stenosis have their licenses restricted or suspended based on medical reports. Always talk to your doctor before getting behind the wheel if you’ve been diagnosed. Will I be paralyzed from spinal stenosis Paralysis from spinal stenosis is rare, but not impossible. The risk depends on how severely the spinal cord is compressed and where the compression occurs. The most dangerous area is the cervical spine. If the narrowing of the canal is significant and it compresses the spinal cord, it can result in a condition called myelopathy — which may lead to: Muscle weakness Loss of balance Loss of bladder or bowel control Permanent nerve damage Partial or full paralysis Again, these outcomes are not the norm, but they are a possibility in high-impact trauma cases. If you’ve been in a serious crash and are showing signs like sudden weakness, incontinence, or severe nerve pain, you need medical attention immediately. From a legal standpoint, these severe symptoms greatly increase the potential value of a settlement. They demonstrate not just short-term pain but long-term or permanent disability. Spinal stenosis claims process Filing a spinal stenosis claim after a car accident isn’t just about paperwork. It’s about telling the full story — clearly, completely, and backed by evidence. 1. Medical diagnosis and records Everything starts with your diagnosis. A primary care doctor might be the first to flag your symptoms, but you’ll likely need a neurologist or orthopedic spine specialist. Imaging (MRI or CT scans) will confirm whether stenosis is present and what’s causing it. 2. Establishing causation This is where many cases hit a wall. You need to connect your spinal stenosis directly to the accident. Insurance companies will try to argue it was pre-existing, degenerative, or unrelated. That’s why timing, symptoms, and past medical history are critical. An attorney may work with your doctors or hire independent medical experts to help show how the crash caused or worsened the condition. 3. Calculating damages Spinal stenosis can lead to thousands in medical bills, missed work, or reduced future earnings. Other damages can include: Pain and suffering Future treatment needs Disability or lifestyle changes Loss of ability to participate in normal activities 4. Negotiation or litigation Once your claim is prepared, your attorney will present it to the insurance company. If the offer isn’t fair, your legal team may file a lawsuit and prepare for trial. Most cases settle before they reach court, but being prepared for both paths is key. Contact Harper, Evans, Hilbrenner & Netemeyer Spinal stenosis after a crash isn’t just a health issue. It’s a legal one — and it can impact your future. If you’re struggling with pain, medical bills, or lost wages after an accident, it’s time to speak with an attorney. At Harper, Evans, Hilbrenner & Netemeyer, we’ve handled countless injury cases involving spinal injuries, nerve damage, and long-term impairments. We know what insurance companies look for — and how to fight back with clear, evidence-driven claims. Reach out for a free case review today. There’s no pressure, and no upfront cost. Let’s talk about your rights, your options, and how we can help.

One second, you’re driving. Next, everything changes. If you’ve been in a crash and are now dealing with severe back pain, tingling, or weakness—you might have a herniated disc. And if that disc injury came from a car accident, you need to understand your rights, your treatment options, and how to protect your health and your claim. A herniated disc after a car accident isn’t just painful. It can affect your ability to work, sleep, and function. But here's the good news: you're not stuck. With the right information—and the right legal support—you can take clear steps to recover, physically and financially. Let’s break it down. What is a herniated disc after a car accident Your spine is made up of vertebrae separated by soft, rubbery discs. These discs act like cushions. When the force from a car crash is too much, one of those discs can get pushed out of place or ruptured. That’s a herniated disc. This can happen even in low-speed accidents. Rear-end collisions are a major cause. The sudden whip of the neck and spine can put intense pressure on the spine’s discs. In a herniated disc, the inner gel-like core (nucleus pulposus) leaks out through the outer layer (annulus fibrosus). When that leaked material touches a nerve, pain happens. And not just in your back. Pain can radiate down your arms or legs depending on the disc location. Common causes of disc herniation in crashes: Seatbelt restraints tightening suddenly Whiplash Direct impact to the back or neck Twisting movements during impact Some people have pre-existing disc issues without symptoms. An accident can aggravate or worsen these, turning a manageable condition into a debilitating one. Symptoms of herniated disc after a car accident Symptoms don’t always show up right away. Many people walk away from the scene thinking they’re fine—only to wake up in serious pain the next day. Here’s what to watch for: Back or neck pain Dull or sharp pain in the spine, especially in the lower back (lumbar) or neck (cervical) area. Numbness or tingling You may feel pins and needles in your arms, hands, legs, or feet. This happens when the herniated disc presses on a nerve root. Muscle weakness Struggling to lift objects or feeling one limb is weaker than the other is a red flag. Pain that radiates Sciatica—pain that shoots down the buttocks and leg—is common with lumbar herniation. Cervical herniation can cause arm or shoulder pain. Loss of bladder or bowel control This is rare, but if it happens, get emergency medical attention immediately. It could indicate cauda equina syndrome, a serious condition caused by severe nerve compression. Don’t guess. These symptoms might resemble a pulled muscle or general soreness. But if you’ve been in a crash, assume it could be more. Get evaluated. Testing and diagnosis Accurate diagnosis is key. You can’t treat what you don’t identify. Start by seeing a doctor as soon as symptoms begin—or sooner. Don’t wait for the pain to become unbearable. Early medical records help your health and your injury claim. Here’s what to expect in the diagnostic process: Physical examination The doctor will check your reflexes, strength, and range of motion. They'll ask questions about pain location, intensity, and what makes it better or worse. Imaging tests MRI (Magnetic Resonance Imaging) – This is the most reliable way to detect a herniated disc. It shows soft tissues and nerve compression. CT scan – Offers detailed images if MRI isn’t possible. X-rays – While they don’t show herniated discs, they can rule out fractures or alignment issues. EMG (Electromyography) – Measures nerve and muscle function to confirm nerve compression. If your injury came from a car accident, be clear with your doctor. Documentation should connect your symptoms directly to the crash. This helps build a solid legal case. Treatment options Treatment depends on how severe the herniation is. Most people don’t need surgery—but they do need a clear plan. Ignoring a herniated disc can lead to chronic pain, permanent nerve damage, or disability. 1. Conservative treatment Most doctors start here: Rest and activity modification – Limit heavy lifting and twisting movements. Physical therapy – Exercises to reduce pain, increase mobility, and strengthen your core. Medications – Anti-inflammatories, muscle relaxers, or short-term opioids. Epidural steroid injections – Reduce inflammation around the nerve. These treatments can last from several weeks to a few months. If there’s no improvement, your doctor may recommend the next step. 2. Surgery Surgical options are usually reserved for severe cases or those that don’t respond to other treatments. Common procedures include: Discectomy – Removal of the herniated portion of the disc. Laminectomy – Removal of part of the vertebra to relieve nerve pressure. Spinal fusion – Stabilizing the spine by fusing two or more vertebrae together. Surgery comes with risks and recovery time. But for many people, it brings relief after months—or years—of debilitating pain. Why legal help matters Medical care for a herniated disc after a car accident can be expensive. MRIs, physical therapy, lost income, surgery—it adds up fast. And in many cases, the insurance company will argue that your condition was pre-existing or unrelated to the crash. That’s where legal representation comes in. At Harper, Evans, Hilbrenner & Netemeyer, we’ve handled hundreds of injury cases involving herniated discs from car accidents. We know how to: Gather strong medical evidence Deal with insurance adjusters who try to minimize your claim Prove the accident directly caused or worsened your condition Fight for compensation for medical bills, lost wages, pain, and long-term care The sooner you contact an attorney, the better. We help protect your rights from day one. You focus on healing—we handle the legal side. Don’t ignore your symptoms If you’ve been in a car accident and are now dealing with back or neck pain, tingling, or weakness—get checked. You don’t have to be in a major crash to suffer a serious injury. A herniated disc after a car accident can turn your life upside down. But with timely medical care and the right legal support, recovery is possible. Need help after a car crash injury? Call Harper, Evans, Hilbrenner & Netemeyer today for a free consultation. We’ll review your case, explain your rights, and help you move forward. 📞 (573) 442-1660 🌐 www.lawmissouri.com

Settling a workers’ compensation claim is a significant step, but if you receive or will soon receive Medicare, your settlement could have lasting financial and medical consequences. Medicare has strict rules about who pays for work-related injuries, and failing to follow these regulations could result in denied coverage or unexpected costs down the road. One key consideration in workers' compensation settlements is a workers' compensation Medicare set-aside (WCMSA). This is a portion of the settlement that must be reserved for future medical expenses related to your injury—expenses that Medicare would otherwise cover. Failing to establish a proper MSA could lead to Medicare refusing to pay for future medical treatments related to your workers’ comp claim. If you're in the process of settling a workers’ compensation case, you need to understand how Medicare is involved and what steps you must take to protect your benefits. Medicare Set-Aside Account A Medicare Set-Aside Account (MSA) is an arrangement in which part of your workers’ compensation settlement is allocated specifically for future medical expenses related to your work injury. Medicare requires these funds to be spent before it will cover any injury-related treatments. The purpose of an MSA is to protect Medicare’s financial interests. If you settle a workers' comp claim for an amount that includes future medical expenses but don't set aside funds for those costs, Medicare could refuse to pay for treatment related to your injury until you have spent the settlement money yourself. Here’s how an MSA typically works: A portion of your workers’ compensation settlement is placed into a separate account. The funds in this account can only be used for medical expenses related to your work injury. You must follow strict Medicare guidelines when using the funds and keep detailed records of expenses. Medicare will not pay for any injury-related care until the MSA funds have been exhausted. For some, setting up an MSA is straightforward, but for others, determining how much to set aside and managing the account properly can be complex. This is where legal guidance becomes essential. Is a Medicare Set-Aside Mandatory? Not every workers' compensation settlement requires an MSA, but certain cases do. Medicare has specific rules about when an MSA is required, based on settlement amounts and Medicare eligibility status. An MSA is mandatory if: You are a current Medicare beneficiary and your settlement exceeds $25,000. You are not yet on Medicare but are reasonably expected to enroll within 30 months, and your settlement is greater than $250,000. Even if an MSA is not legally required, Medicare still has the right to refuse payment for work-related injury treatments if it determines that settlement funds should have been used first. This is why many legal professionals recommend setting up an MSA, even in cases where it's not strictly mandatory. If you don't establish an MSA when required, Medicare can: Deny payment for any medical treatment related to your injury. Demand repayment for any costs Medicare incurs related to your injury. Investigate your settlement to ensure compliance with federal law. If you’re unsure whether your workers’ compensation settlement requires an MSA, consulting an attorney experienced in workers' compensation and Medicare is crucial. Compromise and Release Medicare Set-Aside A Compromise and Release (C&R) settlement is another way to resolve a workers’ compensation case. In a C&R agreement, the injured worker receives a lump-sum payment in exchange for releasing the employer and insurer from future claims. This means that instead of receiving ongoing benefits, the worker gets a one-time payout and assumes responsibility for all future medical costs. If a settlement includes a C&R, an MSA may still be required. Here’s why: If the worker is a Medicare beneficiary, Medicare may still require a portion of the settlement to be placed in an MSA to cover future injury-related medical expenses. Even in cases where a C&R is used, Medicare can still demand repayment if it believes settlement funds were used improperly. Workers who fail to properly allocate their settlement for medical expenses could end up losing Medicare coverage for treatments related to their injury. While a C&R settlement can be beneficial in some cases, it also carries risks. If you agree to a lump sum without properly setting aside funds for future medical care, you could find yourself without the money needed to cover necessary treatments. Before agreeing to a Compromise and Release settlement involving Medicare, it’s critical to consult an attorney who understands the intersection of workers’ compensation and Medicare laws. Common Mistakes to Avoid When Settling a Workers' Compensation Case with Medicare 1. Failing to Establish an MSA When Required If your settlement meets Medicare’s criteria, not setting up an MSA could lead to Medicare refusing coverage for future treatments. 2. Underfunding the MSA If you don’t allocate enough funds to your MSA, Medicare may require you to personally cover medical expenses before it steps in. 3. Improperly Spending MSA Funds MSAs have strict usage rules. The funds can only be spent on Medicare-covered services related to your work injury. Misuse could result in Medicare rejecting future claims. 4. Not Reporting the Settlement to Medicare The Centers for Medicare & Medicaid Services (CMS) must be notified of your settlement. Failing to report it can cause delays in future Medicare coverage. 5. Attempting to Handle the Process Alone Medicare’s rules regarding workers’ compensation settlements are complex. An attorney can help you structure your settlement properly and avoid costly mistakes. Get Legal Guidance for Your Workers' Compensation and Medicare Case If you’re settling a workers’ compensation case and have Medicare or expect to qualify soon, handling the process incorrectly could jeopardize your future benefits. Medicare has strict rules, and failing to follow them can lead to unexpected medical expenses or loss of coverage. At Harper, Evans, Hilbrenner & Netemeyer, we have extensive experience helping injured workers navigate workers’ compensation and Medicare issues. Whether you need guidance on setting up a workers' compensation MSA, negotiating a Compromise and Release settlement, or ensuring compliance with Medicare’s regulations, our legal team is ready to help. Don’t take risks with your settlement. Contact Harper, Evans, Hilbrenner & Netemeyer today for a consultation and protect your future medical coverage.

Let's look at why divorce lawyers say Zuckerberg's marriage was timed to take place after he took his company public. From the experts at HEHN.

Roughly 2 million people in the U.S. suffer car accident-related injuries each year, according to the CDC. Some are obvious right away — broken bones, whiplash, cuts. Others creep in slowly. One of those is spinal stenosis. Spinal stenosis doesn’t always hit you the same day as the crash. It might show up weeks later — numbness in your arms or legs, pain that radiates down your back, tingling that won’t go away. You might think it’s just soreness or aging. But if the narrowing of your spinal canal started after a car accident, you may be dealing with something serious — and you may be eligible for compensation. If you’ve been diagnosed with spinal stenosis after an accident, or you’re starting to show signs, this article walks you through what it means, how it connects to auto collisions, and what the spinal stenosis claims process looks like. Let’s get right into it. What is spinal stenosis Spinal stenosis is a condition where the spaces within your spine — particularly the spinal canal — become narrower. This narrowing puts pressure on the nerves traveling through the spine, which can lead to significant pain, numbness, and weakness, often in the arms or legs. There are two major types of spinal stenosis: Cervical stenosis, which occurs in the neck Lumbar stenosis, the most common type, which affects the lower back Symptoms depend on the location and severity of the narrowing. People with cervical spinal stenosis might have trouble with balance, coordination, or hand function. Those with lumbar spinal stenosis often report leg cramps, shooting pain down the legs (sciatica), or a heavy feeling when walking. You don’t need to be elderly to develop this. While degenerative changes related to aging are a common cause, trauma — like that from a car crash — can cause similar narrowing by altering the structure of the spine. Can spinal stenosis be caused by an auto accident Yes. Trauma is a recognized cause of spinal stenosis, especially in previously healthy individuals. The spine is a delicate system of vertebrae, discs, joints, and nerves. A high-impact collision can throw it out of balance instantly. Here’s what can happen in a crash: Bulging or herniated discs can protrude into the spinal canal. Fractured vertebrae or bone fragments may press against the spinal cord or nerves. Whiplash injuries, especially in rear-end collisions, can destabilize the spine and lead to long-term inflammation or structural changes. This process doesn’t always trigger immediate symptoms. You might walk away from the accident thinking you’re fine. But over weeks or months, pain, numbness, and weakness may set in as inflammation builds or disc material shifts more into the spinal canal. It’s not uncommon for patients to be diagnosed with spinal stenosis during imaging done weeks after the crash — often after initial treatments for whiplash or soft tissue injuries fail to resolve the pain. This delayed onset makes documentation extremely important. Is spinal stenosis a permanent injury In many cases, yes. Spinal stenosis is considered a degenerative condition, and once it begins, it often doesn’t reverse on its own. Treatment focuses on managing symptoms and slowing progression, not curing the condition. Physical therapy, anti-inflammatory medications, corticosteroid injections, and chiropractic care may help in the short term. But if these conservative treatments don’t offer relief, surgery may be recommended — typically a laminectomy or spinal fusion. Even then, there’s no guarantee of full recovery. According to the National Institute of Neurological Disorders and Stroke, the long-term outcome for spinal stenosis varies widely. Some people maintain function with ongoing therapy; others experience progressive disability. If the condition leads to permanent nerve damage, the effects may include chronic pain, loss of mobility, or loss of function in certain limbs. In legal terms, a permanent injury can significantly increase the value of a personal injury settlement. It impacts your quality of life, your ability to earn income, and sometimes your need for future medical care or home modifications. Can you drive a car with spinal stenosis Possibly — but there are limitations. Driving requires physical strength, quick reaction time, and range of motion. If your spinal stenosis limits any of these, driving could be dangerous to you and others. Cervical stenosis may restrict your ability to turn your head or neck, making it hard to check blind spots. Lumbar stenosis can cause numbness or weakness in the legs, which affects braking or accelerating safely. Long drives might also trigger pain flare-ups or muscle spasms that make it harder to concentrate. If you’re prescribed painkillers, muscle relaxants, or anti-inflammatories, you may experience drowsiness or delayed response times. These side effects can increase crash risk and may invalidate your car insurance in the event of a collision. In some cases, people with moderate to severe spinal stenosis have their licenses restricted or suspended based on medical reports. Always talk to your doctor before getting behind the wheel if you’ve been diagnosed. Will I be paralyzed from spinal stenosis Paralysis from spinal stenosis is rare, but not impossible. The risk depends on how severely the spinal cord is compressed and where the compression occurs. The most dangerous area is the cervical spine. If the narrowing of the canal is significant and it compresses the spinal cord, it can result in a condition called myelopathy — which may lead to: Muscle weakness Loss of balance Loss of bladder or bowel control Permanent nerve damage Partial or full paralysis Again, these outcomes are not the norm, but they are a possibility in high-impact trauma cases. If you’ve been in a serious crash and are showing signs like sudden weakness, incontinence, or severe nerve pain, you need medical attention immediately. From a legal standpoint, these severe symptoms greatly increase the potential value of a settlement. They demonstrate not just short-term pain but long-term or permanent disability. Spinal stenosis claims process Filing a spinal stenosis claim after a car accident isn’t just about paperwork. It’s about telling the full story — clearly, completely, and backed by evidence. 1. Medical diagnosis and records Everything starts with your diagnosis. A primary care doctor might be the first to flag your symptoms, but you’ll likely need a neurologist or orthopedic spine specialist. Imaging (MRI or CT scans) will confirm whether stenosis is present and what’s causing it. 2. Establishing causation This is where many cases hit a wall. You need to connect your spinal stenosis directly to the accident. Insurance companies will try to argue it was pre-existing, degenerative, or unrelated. That’s why timing, symptoms, and past medical history are critical. An attorney may work with your doctors or hire independent medical experts to help show how the crash caused or worsened the condition. 3. Calculating damages Spinal stenosis can lead to thousands in medical bills, missed work, or reduced future earnings. Other damages can include: Pain and suffering Future treatment needs Disability or lifestyle changes Loss of ability to participate in normal activities 4. Negotiation or litigation Once your claim is prepared, your attorney will present it to the insurance company. If the offer isn’t fair, your legal team may file a lawsuit and prepare for trial. Most cases settle before they reach court, but being prepared for both paths is key. Contact Harper, Evans, Hilbrenner & Netemeyer Spinal stenosis after a crash isn’t just a health issue. It’s a legal one — and it can impact your future. If you’re struggling with pain, medical bills, or lost wages after an accident, it’s time to speak with an attorney. At Harper, Evans, Hilbrenner & Netemeyer, we’ve handled countless injury cases involving spinal injuries, nerve damage, and long-term impairments. We know what insurance companies look for — and how to fight back with clear, evidence-driven claims. Reach out for a free case review today. There’s no pressure, and no upfront cost. Let’s talk about your rights, your options, and how we can help.

One second, you’re driving. Next, everything changes. If you’ve been in a crash and are now dealing with severe back pain, tingling, or weakness—you might have a herniated disc. And if that disc injury came from a car accident, you need to understand your rights, your treatment options, and how to protect your health and your claim. A herniated disc after a car accident isn’t just painful. It can affect your ability to work, sleep, and function. But here's the good news: you're not stuck. With the right information—and the right legal support—you can take clear steps to recover, physically and financially. Let’s break it down. What is a herniated disc after a car accident Your spine is made up of vertebrae separated by soft, rubbery discs. These discs act like cushions. When the force from a car crash is too much, one of those discs can get pushed out of place or ruptured. That’s a herniated disc. This can happen even in low-speed accidents. Rear-end collisions are a major cause. The sudden whip of the neck and spine can put intense pressure on the spine’s discs. In a herniated disc, the inner gel-like core (nucleus pulposus) leaks out through the outer layer (annulus fibrosus). When that leaked material touches a nerve, pain happens. And not just in your back. Pain can radiate down your arms or legs depending on the disc location. Common causes of disc herniation in crashes: Seatbelt restraints tightening suddenly Whiplash Direct impact to the back or neck Twisting movements during impact Some people have pre-existing disc issues without symptoms. An accident can aggravate or worsen these, turning a manageable condition into a debilitating one. Symptoms of herniated disc after a car accident Symptoms don’t always show up right away. Many people walk away from the scene thinking they’re fine—only to wake up in serious pain the next day. Here’s what to watch for: Back or neck pain Dull or sharp pain in the spine, especially in the lower back (lumbar) or neck (cervical) area. Numbness or tingling You may feel pins and needles in your arms, hands, legs, or feet. This happens when the herniated disc presses on a nerve root. Muscle weakness Struggling to lift objects or feeling one limb is weaker than the other is a red flag. Pain that radiates Sciatica—pain that shoots down the buttocks and leg—is common with lumbar herniation. Cervical herniation can cause arm or shoulder pain. Loss of bladder or bowel control This is rare, but if it happens, get emergency medical attention immediately. It could indicate cauda equina syndrome, a serious condition caused by severe nerve compression. Don’t guess. These symptoms might resemble a pulled muscle or general soreness. But if you’ve been in a crash, assume it could be more. Get evaluated. Testing and diagnosis Accurate diagnosis is key. You can’t treat what you don’t identify. Start by seeing a doctor as soon as symptoms begin—or sooner. Don’t wait for the pain to become unbearable. Early medical records help your health and your injury claim. Here’s what to expect in the diagnostic process: Physical examination The doctor will check your reflexes, strength, and range of motion. They'll ask questions about pain location, intensity, and what makes it better or worse. Imaging tests MRI (Magnetic Resonance Imaging) – This is the most reliable way to detect a herniated disc. It shows soft tissues and nerve compression. CT scan – Offers detailed images if MRI isn’t possible. X-rays – While they don’t show herniated discs, they can rule out fractures or alignment issues. EMG (Electromyography) – Measures nerve and muscle function to confirm nerve compression. If your injury came from a car accident, be clear with your doctor. Documentation should connect your symptoms directly to the crash. This helps build a solid legal case. Treatment options Treatment depends on how severe the herniation is. Most people don’t need surgery—but they do need a clear plan. Ignoring a herniated disc can lead to chronic pain, permanent nerve damage, or disability. 1. Conservative treatment Most doctors start here: Rest and activity modification – Limit heavy lifting and twisting movements. Physical therapy – Exercises to reduce pain, increase mobility, and strengthen your core. Medications – Anti-inflammatories, muscle relaxers, or short-term opioids. Epidural steroid injections – Reduce inflammation around the nerve. These treatments can last from several weeks to a few months. If there’s no improvement, your doctor may recommend the next step. 2. Surgery Surgical options are usually reserved for severe cases or those that don’t respond to other treatments. Common procedures include: Discectomy – Removal of the herniated portion of the disc. Laminectomy – Removal of part of the vertebra to relieve nerve pressure. Spinal fusion – Stabilizing the spine by fusing two or more vertebrae together. Surgery comes with risks and recovery time. But for many people, it brings relief after months—or years—of debilitating pain. Why legal help matters Medical care for a herniated disc after a car accident can be expensive. MRIs, physical therapy, lost income, surgery—it adds up fast. And in many cases, the insurance company will argue that your condition was pre-existing or unrelated to the crash. That’s where legal representation comes in. At Harper, Evans, Hilbrenner & Netemeyer, we’ve handled hundreds of injury cases involving herniated discs from car accidents. We know how to: Gather strong medical evidence Deal with insurance adjusters who try to minimize your claim Prove the accident directly caused or worsened your condition Fight for compensation for medical bills, lost wages, pain, and long-term care The sooner you contact an attorney, the better. We help protect your rights from day one. You focus on healing—we handle the legal side. Don’t ignore your symptoms If you’ve been in a car accident and are now dealing with back or neck pain, tingling, or weakness—get checked. You don’t have to be in a major crash to suffer a serious injury. A herniated disc after a car accident can turn your life upside down. But with timely medical care and the right legal support, recovery is possible. Need help after a car crash injury? Call Harper, Evans, Hilbrenner & Netemeyer today for a free consultation. We’ll review your case, explain your rights, and help you move forward. 📞 (573) 442-1660 🌐 www.lawmissouri.com

Settling a workers’ compensation claim is a significant step, but if you receive or will soon receive Medicare, your settlement could have lasting financial and medical consequences. Medicare has strict rules about who pays for work-related injuries, and failing to follow these regulations could result in denied coverage or unexpected costs down the road. One key consideration in workers' compensation settlements is a workers' compensation Medicare set-aside (WCMSA). This is a portion of the settlement that must be reserved for future medical expenses related to your injury—expenses that Medicare would otherwise cover. Failing to establish a proper MSA could lead to Medicare refusing to pay for future medical treatments related to your workers’ comp claim. If you're in the process of settling a workers’ compensation case, you need to understand how Medicare is involved and what steps you must take to protect your benefits. Medicare Set-Aside Account A Medicare Set-Aside Account (MSA) is an arrangement in which part of your workers’ compensation settlement is allocated specifically for future medical expenses related to your work injury. Medicare requires these funds to be spent before it will cover any injury-related treatments. The purpose of an MSA is to protect Medicare’s financial interests. If you settle a workers' comp claim for an amount that includes future medical expenses but don't set aside funds for those costs, Medicare could refuse to pay for treatment related to your injury until you have spent the settlement money yourself. Here’s how an MSA typically works: A portion of your workers’ compensation settlement is placed into a separate account. The funds in this account can only be used for medical expenses related to your work injury. You must follow strict Medicare guidelines when using the funds and keep detailed records of expenses. Medicare will not pay for any injury-related care until the MSA funds have been exhausted. For some, setting up an MSA is straightforward, but for others, determining how much to set aside and managing the account properly can be complex. This is where legal guidance becomes essential. Is a Medicare Set-Aside Mandatory? Not every workers' compensation settlement requires an MSA, but certain cases do. Medicare has specific rules about when an MSA is required, based on settlement amounts and Medicare eligibility status. An MSA is mandatory if: You are a current Medicare beneficiary and your settlement exceeds $25,000. You are not yet on Medicare but are reasonably expected to enroll within 30 months, and your settlement is greater than $250,000. Even if an MSA is not legally required, Medicare still has the right to refuse payment for work-related injury treatments if it determines that settlement funds should have been used first. This is why many legal professionals recommend setting up an MSA, even in cases where it's not strictly mandatory. If you don't establish an MSA when required, Medicare can: Deny payment for any medical treatment related to your injury. Demand repayment for any costs Medicare incurs related to your injury. Investigate your settlement to ensure compliance with federal law. If you’re unsure whether your workers’ compensation settlement requires an MSA, consulting an attorney experienced in workers' compensation and Medicare is crucial. Compromise and Release Medicare Set-Aside A Compromise and Release (C&R) settlement is another way to resolve a workers’ compensation case. In a C&R agreement, the injured worker receives a lump-sum payment in exchange for releasing the employer and insurer from future claims. This means that instead of receiving ongoing benefits, the worker gets a one-time payout and assumes responsibility for all future medical costs. If a settlement includes a C&R, an MSA may still be required. Here’s why: If the worker is a Medicare beneficiary, Medicare may still require a portion of the settlement to be placed in an MSA to cover future injury-related medical expenses. Even in cases where a C&R is used, Medicare can still demand repayment if it believes settlement funds were used improperly. Workers who fail to properly allocate their settlement for medical expenses could end up losing Medicare coverage for treatments related to their injury. While a C&R settlement can be beneficial in some cases, it also carries risks. If you agree to a lump sum without properly setting aside funds for future medical care, you could find yourself without the money needed to cover necessary treatments. Before agreeing to a Compromise and Release settlement involving Medicare, it’s critical to consult an attorney who understands the intersection of workers’ compensation and Medicare laws. Common Mistakes to Avoid When Settling a Workers' Compensation Case with Medicare 1. Failing to Establish an MSA When Required If your settlement meets Medicare’s criteria, not setting up an MSA could lead to Medicare refusing coverage for future treatments. 2. Underfunding the MSA If you don’t allocate enough funds to your MSA, Medicare may require you to personally cover medical expenses before it steps in. 3. Improperly Spending MSA Funds MSAs have strict usage rules. The funds can only be spent on Medicare-covered services related to your work injury. Misuse could result in Medicare rejecting future claims. 4. Not Reporting the Settlement to Medicare The Centers for Medicare & Medicaid Services (CMS) must be notified of your settlement. Failing to report it can cause delays in future Medicare coverage. 5. Attempting to Handle the Process Alone Medicare’s rules regarding workers’ compensation settlements are complex. An attorney can help you structure your settlement properly and avoid costly mistakes. Get Legal Guidance for Your Workers' Compensation and Medicare Case If you’re settling a workers’ compensation case and have Medicare or expect to qualify soon, handling the process incorrectly could jeopardize your future benefits. Medicare has strict rules, and failing to follow them can lead to unexpected medical expenses or loss of coverage. At Harper, Evans, Hilbrenner & Netemeyer, we have extensive experience helping injured workers navigate workers’ compensation and Medicare issues. Whether you need guidance on setting up a workers' compensation MSA, negotiating a Compromise and Release settlement, or ensuring compliance with Medicare’s regulations, our legal team is ready to help. Don’t take risks with your settlement. Contact Harper, Evans, Hilbrenner & Netemeyer today for a consultation and protect your future medical coverage.

Let's look at why divorce lawyers say Zuckerberg's marriage was timed to take place after he took his company public. From the experts at HEHN.

Suffering an injury at work is stressful enough without having to worry about lost income. If you're unable to work due to a job-related injury or illness, workers' compensation should cover your lost wages. But when does workers' comp start paying lost wages? Understanding the timeline and process can help you plan financially while recovering. At Harper, Evans, Hilbrenner & Netemeyer, we’ve helped countless injured workers secure the compensation they deserve. Below, we break down how workers' comp handles lost wages, when payments begin, and what you need to know about eligibility. Does Workers Comp Cover Lost Wages? Yes, workers’ compensation provides wage replacement benefits if you’re unable to work due to a work-related injury or illness. The exact amount you receive and when it starts depends on your state’s laws and your specific case. Generally, workers' comp covers a percentage of your pre-injury wages rather than your full paycheck. How Much Does Workers Comp Pay for Lost Wages? The amount you receive varies by state, but most states provide temporary total disability (TTD) benefits equal to about two-thirds (66.67%) of your average weekly wage (AWW), subject to state-imposed maximums. For example: In Missouri, the maximum TTD benefit for accidents occurring from July 1, 2024, through June 30, 2025, is $1,228.04 per week. In Illinois, the maximum weekly TTD benefit for accidents occurring from January 15, 2024, to July 14, 2024, is $1,897.92. Your AWW is typically calculated based on your earnings in the 52 weeks before your injury . If you work seasonally or irregular hours, the calculation may be adjusted accordingly. Exceptions: If you can return to work in a light-duty role that pays less than your pre-injury job, you may qualify for temporary partial disability (TPD) benefits to cover part of the wage difference. If your injury leads to permanent disability, you may receive permanent total disability (PTD) or permanent partial disability (PPD) benefits. When Does Workers Comp Start Paying Lost Wages? The timing of your first workers' comp payment depends on three key factors: Your state's waiting period How quickly you report your injury The speed of your employer and insurance company in processing your claim 1. State-Mandated Waiting Periods Most states impose a waiting period before wage loss benefits kick in. This means you won't receive payment for the first few days of lost work unless your disability extends beyond a certain timeframe. For example: Missouri: 3-day waiting period. If you're off work for more than 14 days, you receive back pay for the first three days. Illinois: 3-day waiting period, with retroactive pay if you're out for 14+ days. 2. Reporting Your Injury Quickly To start receiving lost wage benefits as soon as possible, report your injury to your employer immediately. Many states require you to notify your employer within a specific time frame: Missouri: 30 days Illinois: 45 days Failing to report on time can delay or even jeopardize your claim. 3. Claim Processing Times Once your employer is notified, they must file a claim with their workers' comp insurance provider. The insurer then reviews the claim, which involves: Confirming the injury is work-related Reviewing medical records Determining wage replacement eligibility Typical payment timeline: If your claim is approved, you should receive your first payment within 14–21 days from the date you reported your injury. Payments continue on a weekly or biweekly basis. If your claim is denied, you have the right to appeal (more on that below). What If Your Workers Comp Claim Is Delayed or Denied? Workers’ comp insurance companies don’t always process claims quickly. If your benefits are delayed, you can take action: Common Reasons for Payment Delays The employer fails to file the claim promptly. Insurance disputes whether your injury is work-related. Lack of medical documentation. Missed deadlines in reporting the injury. What You Can Do Follow up with your employer to confirm they filed the claim. Keep detailed records of medical visits, missed workdays, and communications with the insurer. Consult a workers’ compensation attorney if the insurance company is stalling or wrongfully denying benefits. At Harper, Evans, Hilbrenner & Netemeyer, we’ve successfully helped injured workers challenge unfair delays and denials. If you’re facing obstacles in getting paid, we can step in and fight for your rights. How Long Do Workers Comp Benefits Last? Wage replacement benefits last until you’re medically cleared to return to work or reach maximum medical improvement (MMI)—whichever comes first. MMI means your condition has stabilized and further recovery is unlikely. Here’s a general breakdown: Temporary Total Disability (TTD): Paid until you can return to work. Temporary Partial Disability (TPD): Paid if you return to a lower-paying light-duty job. Permanent Partial Disability (PPD): Paid if you have lasting impairments but can still work in some capacity. Permanent Total Disability (PTD): Paid indefinitely if you cannot return to any type of work. Your doctor’s evaluation plays a key role in determining when payments end. If you disagree with their assessment, you have the right to request an independent medical examination (IME). Can You Work While Receiving Workers Comp Benefits? It depends on your work restrictions. If your doctor approves light-duty work, you may return with modified tasks. However, if light-duty pays less than your pre-injury wages, workers’ comp may cover a portion of the difference. Be honest about your work status. If you return to work while still collecting full wage replacement benefits, it could be considered fraud, leading to fines or loss of benefits. Get Legal Help for Workers Comp Wage Loss Claims If you're waiting too long for workers' comp to start paying lost wages, or if your claim has been unfairly denied, don't go it alone. Insurance companies don’t always play fair, but you have legal rights. At Harper, Evans, Hilbrenner & Netemeyer, we help injured workers secure the compensation they’re entitled to. Whether you're struggling with a delayed claim, a denied claim, or simply have questions about your benefits, our experienced attorneys are ready to assist. 📞 Call us today for a free consultation and let us help you get the financial support you need while recovering.

When you’re injured or too sick to work, financial stability becomes a major concern. You might be wondering: does Workers’ Compensation cover this? Or does Short-Term Disability apply? Understanding the difference between Workers’ Comp and Short-Term Disability Insurance is crucial because the type of benefits you receive depends on how, when, and where your injury or illness occurred. At Harper, Evans, Hilbrenner & Netemeyer, we specialize in helping employees navigate their legal rights when dealing with workplace injuries and claims. In this article, we’ll break down the key differences, how they work, and what you need to know to get the compensation you deserve. Workers’ Comp Insurance Workers’ Compensation (Workers’ Comp) is a state-mandated insurance program that provides medical coverage and wage replacement to employees who suffer work-related injuries or illnesses. Employers are required to carry this insurance, and in return, employees generally cannot sue their employer for workplace injuries. Key Features of Workers’ Comp: Covers work-related injuries and illnesses – If you are injured while performing job duties, Workers’ Comp provides benefits, regardless of who was at fault. Medical expenses are fully covered – Your employer’s insurance pays for doctor visits, hospital stays, prescriptions, rehabilitation, and any necessary medical treatments related to the injury. Partial wage replacement – If your injury keeps you out of work, you typically receive around 66% of your average weekly wages, subject to state maximums. Disability benefits – Depending on the severity of your injury, you may qualify for temporary or permanent disability payments. No income taxes on benefits – Unlike wages, Workers’ Comp benefits are not taxable at the state or federal level. You cannot be fired for filing a claim – Employers cannot retaliate against workers for seeking benefits under Workers’ Comp laws. Each state has its own specific rules, including maximum payout limits and eligibility requirements. Short-Term Disability Insurance Short-Term Disability Insurance (STD) is a private insurance policy that provides income replacement if you are unable to work due to a non-work-related injury, illness, or pregnancy. Some employers offer STD coverage as part of their benefits package, while others require employees to purchase it independently. Key Features of Short-Term Disability Insurance: Covers non-work-related injuries and illnesses – If you get sick or injured outside of work, STD replaces a portion of your lost wages. Waiting period applies – There is typically a waiting period (often 7 to 14 days) before benefits begin. Pays a percentage of your income – Most policies cover 50% to 70% of your salary for a limited period, usually 3 to 6 months. Medical conditions covered vary – Coverage often includes recovery from surgery, pregnancy complications, or serious illnesses like cancer. Employer-provided or privately purchased – Some employers offer STD as a benefit, but many employees must purchase it independently. Unlike Workers’ Comp, STD does not cover medical bills. It is strictly designed to replace lost wages when you’re unable to work due to a non-job-related medical condition. Differences Between Workers’ Comp and Short-Term Disability Insurance

Car accidents can turn your life upside down in an instant. Medical bills pile up, vehicles need repairs, and insurance companies start asking questions. One of the biggest concerns after a crash is figuring out who is responsible for covering the damages. Is Missouri a no-fault state? The short answer is no—Missouri follows a fault-based system, meaning the driver responsible for the accident is also responsible for covering the costs. But what does that mean for you? Understanding Missouri’s car accident laws is essential if you’ve been involved in a crash. Whether you’re filing an insurance claim, negotiating a settlement, or considering legal action, knowing how the system works can make all the difference. Below, we’ll break down Missouri’s fault-based laws, car insurance requirements, and how comparative fault could impact your claim. What Does No-Fault State Mean? When it comes to car accident laws, states are divided into fault-based (tort states) and no-fault states. In a no-fault state, each driver’s insurance covers their own medical expenses and lost wages, no matter who caused the crash. This system is designed to simplify claims and reduce lawsuits over minor injuries. No-fault states require drivers to carry Personal Injury Protection (PIP) coverage, which pays for medical bills regardless of fault. Missouri, however, follows a fault-based system, also known as a tort system. This means that after an accident, the at-fault driver (and their insurance) is responsible for paying damages, including medical bills, property damage, and lost wages. If you were injured in a crash, you generally have three options to seek compensation: File a claim with your own insurance (which may then seek reimbursement from the at-fault driver’s insurer). File a claim against the at-fault driver’s insurance to cover your damages. File a personal injury lawsuit against the at-fault driver if their insurance is insufficient or denies liability. This system allows injured parties to recover full damages but often leads to disputes over fault and compensation, making legal guidance important in many cases. Missouri Car Insurance Requirements Because Missouri is a fault-based state, drivers must carry liability insurance to cover potential damages if they cause an accident. The minimum insurance requirements in Missouri are: $25,000 per person for bodily injury $50,000 per accident for bodily injury involving multiple people $10,000 per accident for property damage Uninsured motorist coverage: $25,000 per person and $50,000 per accident While these minimums provide basic protection, they may not be enough in a serious accident. Medical bills and vehicle repairs can easily exceed these limits, leaving at-fault drivers personally responsible for additional costs. Many drivers choose to purchase higher coverage limits for better financial protection. Driving without insurance in Missouri is illegal and can lead to fines, license suspension, and higher future premiums. Additionally, if an uninsured driver causes an accident, it can be difficult for victims to recover compensation—though Missouri’s uninsured motorist coverage helps protect against this risk. How Does Comparative Fault Impact a Missouri Car Accident? One of the most important aspects of Missouri’s car accident laws is pure comparative fault. This rule affects how much compensation you can receive if you’re partially responsible for an accident. Under pure comparative fault, the amount of compensation you receive is reduced by your percentage of fault. For example: If you are awarded $100,000 in damages but found 20% at fault, your compensation is reduced by 20%, leaving you with $80,000. Even if you are 80% at fault, you can still recover 20% of your damages. This system differs from modified comparative fault states, where you cannot recover compensation if you are more than 50% responsible for the accident. In Missouri, you can still recover damages even if you were mostly at fault, though your settlement will be reduced accordingly. Insurance companies often use comparative fault to minimize payouts. They may argue that you were partially responsible to reduce the amount they have to pay. This is why working with an experienced attorney can be crucial in ensuring you receive a fair settlement. What Should You Do After a Car Accident in Missouri? If you’ve been in a car accident in Missouri, taking the right steps can help protect your rights and strengthen your case: Call 911 – Always report the accident to law enforcement. A police report can be valuable evidence when filing an insurance claim or lawsuit. Exchange information – Get the other driver’s name, contact information, insurance details, and license plate number. Document the scene – Take photos of the vehicles, injuries, road conditions, and any traffic signs or signals. If there are witnesses, get their contact information. Seek medical attention – Even if you don’t feel injured, some conditions (like whiplash or internal injuries) may not show symptoms right away. Notify your insurance company – Report the accident as soon as possible, but be cautious when speaking with adjusters. Anything you say could be used to minimize your claim. Consult a personal injury attorney – If you’re injured or facing disputes over fault, legal representation can help ensure you receive fair compensation. When Should You Contact a Personal Injury Attorney? Not every car accident requires an attorney, but if you’ve been injured, dealing with insurance companies can be a challenge. Adjusters often try to settle claims quickly and for as little as possible. They may downplay injuries or argue that you were partially at fault to reduce their payout. At Harper, Evans, Hilbrenner & Netemeyer, we have years of experience helping accident victims recover fair compensation. Whether you’re facing medical expenses, lost wages, or long-term injuries, our team is here to fight for what you deserve. We handle negotiations with insurers, gather evidence, and build strong cases to maximize settlements. Don’t settle for less than you’re owed. Contact Harper, Evans, Hilbrenner & Netemeyer today for a free consultation. We’ll review your case, explain your rights, and help you navigate the legal process with confidence. Conclusion Missouri is not a no-fault state. Instead, it follows a fault-based system, meaning the at-fault driver is responsible for damages. Missouri’s pure comparative fault rule allows you to seek compensation even if you share some blame for the accident. If you’ve been injured, knowing your rights and options can make a significant difference in your recovery. Harper, Evans, Hilbrenner & Netemeyer is here to provide expert legal support and fight for the compensation you deserve. Need legal advice? Contact us today for a free consultation.

Unsafe living conditions in an apartment complex can lead to severe injuries and financial losses. Whether it’s a slip-and-fall accident, faulty wiring causing a fire, or inadequate security leading to an assault, tenants have legal rights. If you’ve suffered harm due to landlord negligence, you may have grounds for a lawsuit. In this guide, we’ll walk you through how to sue an apartment complex for negligence, what you need to prove, and how to protect your rights as a tenant. Can I Sue an Apartment Complex? Yes, you can sue an apartment complex if their negligence caused you harm. Negligence means they failed to take reasonable care in maintaining a safe living environment. This applies to both physical injuries and property damage. To have a valid claim, you must prove: Duty of care: The landlord or property management had a legal responsibility to maintain a safe property. Breach of duty: They failed to fix or warn about hazards. Causation: Their negligence directly caused your injuries. Damages: You suffered actual harm, such as medical bills or lost wages. Who Can Be Held Liable? Depending on the situation, you may sue: The apartment complex owner if they failed to maintain safe conditions. The property management company if they ignored complaints or failed to perform repairs. Third-party contractors (such as security companies or maintenance providers) if their negligence contributed to the incident. How to Prove Apartment Complex Negligence Winning a negligence claim requires strong evidence. Here’s what you need: 1. Document the Hazard Take clear photos or videos of the dangerous condition that caused your injury. This includes broken stairs, poor lighting, water leaks, or security failures. 2. Report the Issue in Writing If you previously complained about the issue, provide copies of emails, letters, or maintenance requests. This proves the landlord was aware of the problem but failed to act. 3. Gather Witness Statements If neighbors or visitors saw the dangerous condition or your accident, their testimony can strengthen your case. 4. Obtain Medical Records If you were injured, seek medical attention immediately. Your medical records will link the injury to the apartment’s negligence. 5. Review Lease Agreements and Local Laws Some leases include clauses on maintenance responsibilities. Additionally, local landlord-tenant laws set minimum safety standards that apartment complexes must follow. Examples of Negligent Landlords or Apartment Complexes Many types of negligence can justify a lawsuit, including: 1. Slip-and-Fall Hazards Wet floors in common areas with no warning signs Icy sidewalks that weren’t salted or cleared Loose carpeting or broken stairs 2. Inadequate Security Poorly lit parking lots or hallways Broken locks on entrances or apartments Lack of security personnel in high-crime areas 3. Fire Hazards Faulty electrical wiring causing electrical fires Lack of smoke detectors or fire extinguishers Blocked emergency exits 4. Unsafe Living Conditions Mold infestations from water leaks Pest infestations due to poor maintenance Unstable balconies or collapsing ceilings 5. Negligent Maintenance Plumbing leaks that cause property damage Heating or air conditioning failures Broken elevators leading to injuries What Are My Rights as a Tenant? Tenants have legal protections under landlord-tenant laws. Some common rights include: Right to a habitable home: The landlord must provide safe, livable conditions. Right to repairs: Landlords must fix dangerous conditions within a reasonable time. Right to withhold rent: In some states, you may withhold rent if repairs aren’t made. Right to sue for damages: If the apartment complex’s negligence harms you, you can seek compensation for medical bills, lost wages, and pain and suffering. If a landlord fails to address serious hazards, tenants can also report them to local housing authorities. How Much Can I Sue For? The compensation you can recover depends on the extent of your damages. A lawsuit against an apartment complex may cover: Medical expenses: Hospital bills, physical therapy, medication costs Lost wages: Compensation for time missed from work Pain and suffering: Physical and emotional distress caused by injuries Property damage: If your belongings were damaged due to landlord negligence In some cases, courts may award punitive damages if the landlord acted recklessly or ignored serious safety hazards. Do I Need a Personal Injury Attorney? Suing an apartment complex can be challenging. Property owners and management companies often have legal teams to fight claims. An experienced personal injury attorney can help by: Evaluating your case to determine if you have a strong claim Negotiating with landlords and insurers to secure fair compensation Filing a lawsuit if the apartment complex refuses to settle Representing you in court if needed Having a lawyer significantly increases your chances of winning a case and getting the compensation you deserve. Final Thoughts If you’ve suffered an injury due to apartment complex negligence, you have legal options. Document everything, seek medical attention, and consult an attorney. Holding negligent landlords accountable not only helps you recover damages but also ensures safer living conditions for other tenants. For expert legal guidance, reach out to Harper, Evans, Hilbrenner & Netemeyer. Our team has the experience to fight for your rights and help you secure the compensation you deserve.